We’re excited to welcome Leverage Traders to the Flat Money protocol. As we prepare for launch, we want to outline how Flat Money’s rETH Perpetual Futures Market works. We'll also highlight the benefits and FMP incentives available for Leverage Traders who participate in the Perpetual Futures Market after launch.

Bringing Liquidity for rETH Perpetual Futures to Base

Flat Money will be the first protocol to create an onchain Perpetual Futures Market for Rocket Pool ETH (rETH) where interest is earned in a liquid staking derivative. We’re bringing this specialized perpetual market to Base to provide Leverage Traders with the best user experience and the lowest transaction fees.

At launch, Flat Money’s Perpetual Futures Market will have a minimum of $2.5M in rETH liquidity for Leverage Traders to borrow and open leverage positions. The funding rate, which we refer to as the Borrow Rate, will be competitive with other onchain perpetual futures markets, so traders will be able to long rETH at favorable rates.

How can Flat Money offer competitive funding rates? Let’s review how the Perpetual Futures Market works within the Flat Money protocol.

Flat Money’s Perpetual Futures Market

The Flat Money protocol is made up of two markets:

- The Flat Money (UNIT) Market. In this market, users can deposit rETH and mint the UNIT flatcoin. UNIT holders provide the rETH held in the protocol’s liquidity pool.

- The Perpetual Futures Market. In this market, users can deposit rETH margin collateral, borrow rETH, and open leverage long positions on rETH. Leverage Traders borrow rETH from UNIT holders, for which traders pay trading fees and the funding rate fee so long as the funding rate is positive.

For an overview of the Perpetual Futures Market, see this short video.

Because Leverage Traders can borrow rETH from UNIT holders, the protocol can offer all users a capital-efficient marketplace that provides incentives across both markets to ensure the protocol maintains a delta-neutral equilibrium.

Achieving Balance Between Both Markets

The Borrow Rate (i.e., the funding rate) is the ultimate incentive that attracts market participants to provide rETH liquidity or open additional leverage positions based on the need within the protocol. Over time, the Borrow Rate provides UNIT holders and Leverage Traders with the necessary incentives to keep a delta-neutral position between the Flat Money and Perpetual Futures Markets.

When the Flat Money Market has more rETH liquidity than is being borrowed by Leverage Traders in the Perpetual Futures Market, the Borrow Rate will become more competitive with existing funding rates in the market. In some market conditions, the Borrow Rate could turn negative and UNIT holders would pay Leverage Traders to open long rETH positions. When demand for leverage is low, the Borrow Rate will decrease or turn negative to attract more Leverage Traders within the Perpetual Futures Market.

When the Perpetual Futures Market lacks the rETH liquidity necessary to meet the demand for leverage, the Borrow Rate will increase and act as an incentive to attract people to deposit rETH and mint UNIT. The added rETH will provide the liquidity Leverage Traders need to open new leverage positions.

For an example of how this works, see the Flat Money documentation.

At launch, the Borrow Rate will be attractive given there will be at least $2.5M in rETH liquidity for Leverage Traders to borrow and open new leverage positions. The Borrow Rate will act as one incentive, while the Flat Money Points (FMP) incentives will be another reason to participate in the Perpetual Futures Market at launch.

FMP Incentives for Leverage Traders at Launch

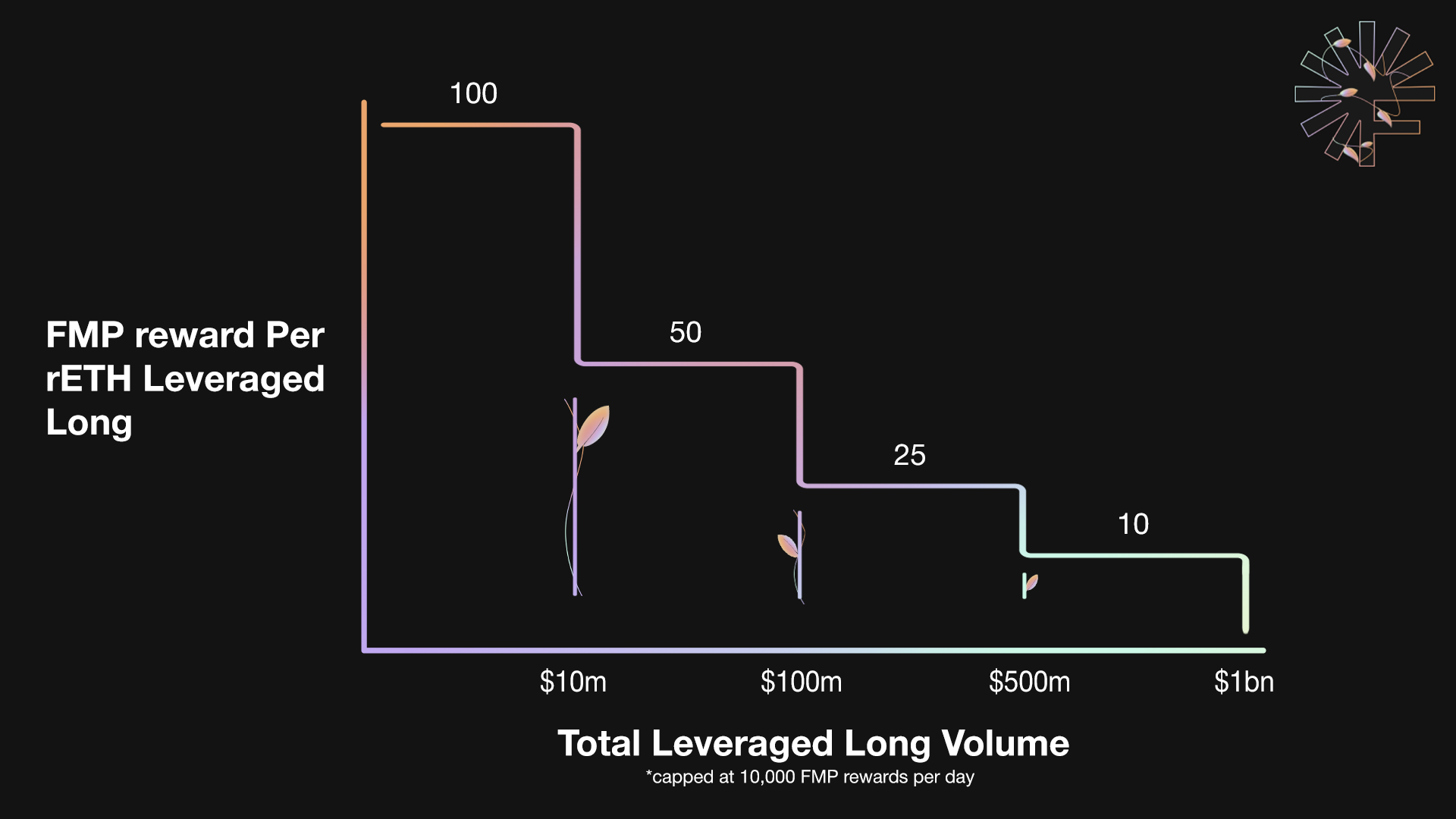

Early Leverage Traders can earn FMP incentives based on their trading volume. At launch, FMP incentives will be the greatest and will decrease over time as total trading volume increases in Flat Money’s Perpetual Futures Market.

Traders can earn FMP for every 1 rETH of volume according to the following distribution schedule.

- 100 FMP per 1 rETH | $0–$10M of volume

- 50 FMP per 1 rETH | $10M–$100M of volume

- 25 FMP per 1 rETH | $100M–$500M of volume

- 10 FMP per 1 rETH | $500M–$1B of volume

Benefits for Other Perpetual Futures Markets on Base

After Flat Money launches, we’ll explore ways we can work with other perpetual markets and established communities like Synthetix. The Perpetual Futures Market we offer within Flat Money is specialized, while protocols like Synthetix have many markets and broad functionality.

We envision working with other perpetual protocols to offer our Leverage Traders the ability to hedge their open positions within Flat Money and easily accomplish funding rate arbitrage between markets.

Flat Money will work with the dHEDGE and Toros teams to create vaults that can provide some of these solutions, which will entail building on top of Synthetix v3 on Base. These yield opportunities will increase volume across markets, while boosting fees for Flat Money and Synthetix users.

At the end of the day, we’re not competing with established onchain perpetual markets. Instead, we’re creating a specialized futures marketplace for ETH liquid staking derivatives, which should allow for many opportunities to work with other protocols and teams within the Base ecosystem.

Our mission is to create decentralized money that’s open and accessible. We’ll work with any protocol that’s passionate about further adoption of decentralized onchain money.

Creating Deep Liquidity for LSD Perpetuals on Base

Once Flat Money launches in the coming week, we’ll begin our movement to bring decentralized onchain money to the masses. As Flat Money grows, so will the liquidity within the Perpetual Futures Market. In the future, Flat Money will add other LSD tokens to create a diversified basket of decentralized collateral to back UNIT. This will create an LSD Perpetual Futures Market with unrivaled liquidity anywhere onchain or offchain.

Those Leverage Traders who participate early on in Flat Money’s journey will have an opportunity to go long rETH, earn FMP, and be a part of a movement to create unstoppable, inflation-resistant decentralized money.

This is the final post in our Building Better Money series. If you missed the first two, you can catch up and read “The ETH Standard: A Path Toward Scalable, Decentralized Onchain Money” and “The Case for UNIT: Building Better Onchain Money on Base”.

If you’re not already, we encourage you to join us on Discord, follow us on Twitter and Farcaster, and sign up for the latest news from the Flat Money blog, as we near the launch of the Flat Money protocol in the next week.