The Flat Money vision aims to return DeFi to its cypherpunk roots, untethering ourselves from centralization and TradFi risks to create onchain money free from offchain risks.

The onchain movement is rooted in cypherpunk ideals that promote a more open internet, where applications are censorship-resistant; open source and fully auditable; and as free from centralization as possible.

Decentralized finance (DeFi) is an extension of this movement, which aims to build an alternative financial system onchain where anyone can store value, transact, and develop new applications.

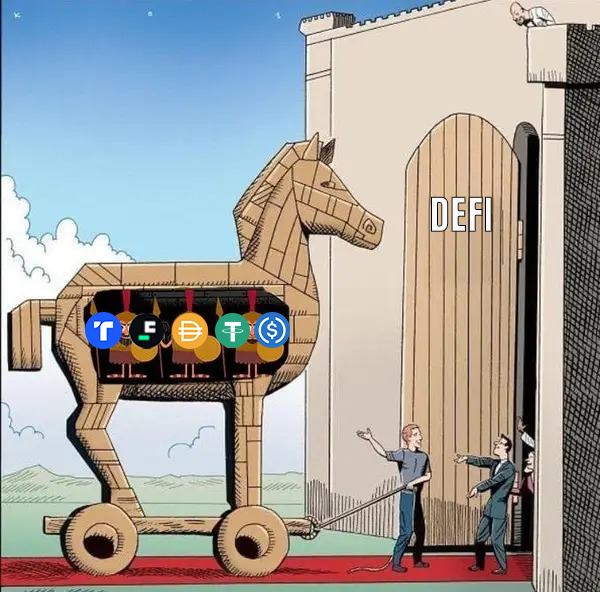

While the original intent was to create financial rails free from the traditional financial system's pitfalls and risks, there's been a movement to add more exposure to real-world assets onchain. This trend introduces added centralization and legacy financial risks to the onchain ecosystem.

This compromise on cypherpunk ideals has led to an onchain economy where our money is dominated by stablecoins, many of which sacrifice decentralization for scalability. As a consequence, there are now billions of dollars in offchain funds tied into the legacy financial system integrated across DeFi.

When we consider the motivations behind DeFi, it’s clear that we never intended to build an onchain financial system that could be thrown into chaos if one stablecoin provider’s bank became insolvent.

This event, and others, served as a wake-up call and a reminder that we need to change course. In December 2023, Vitalik published “Make Ethereum Cypherpunk Again” on his personal blog, with a call to action for the Ethereum community:

These two things: the growing awareness that unchecked centralization and over-financialization cannot be what "crypto is about", and the key technologies mentioned above that are finally coming to fruition, together present us with an opportunity to take things in a different direction. Namely, to make at least a part of the Ethereum ecosystem embody the permissionless, decentralized, censorship-resistant, open-source ecosystem that we originally came to build.

The Flat Money team couldn’t agree more.

The Need for Native Onchain Money

More than anything, people use crypto as a store of value. This is especially true in countries where censorship and inflation are severe. There’s a popular narrative that ETH is money, but it is still very volatile and usage data highlights that stablecoins are more often used to store value than ETH or BTC. Overwhelmingly, people buy crypto that is easy to access, affordable to transact with, and provides a reliable store of value with low volatility.

For individuals in countries with high inflation and volatile prices who are seeking to preserve their purchasing power, a highly volatile store of value is not ideal. Hence, stablecoins have become the preferred crypto asset for preserving value onchain in countries where inflation poses a significant challenge.

By using stablecoins, people in Latin America have been able to preserve their purchasing power and engage in cross-border transactions seamlessly. Historically, the easiest way to do this has been through CEXes using centralized stablecoins. However, in the last two years, we’ve seen CEXes collapse and cause egregious harm across the onchain economy.

Centralized stablecoins have solved for scalability by forgoing decentralization partially or completely, while adding TradFi exposure to onchain markets. The lack of transparent reporting from entities like Tether and USDC means that bank-run scenarios, similar to what occurred in 2023, can trigger these stablecoins to depeg, resulting in severe consequences. The USDC depeg in 2023 exemplified this risk, as it triggered widespread liquidations and chaos across DeFi.

According to CoinGecko, the top five stablecoins by market capitalization are Tether’s USDT (100% centralized); Circle’s USDC (100% centralized); MakerDAO’s DAI (collateralized by over 50% centralized assets); First Digital’s FDUSD (100% centralized); and TrueUSD’s TUSD (100% centralized). These five stablecoins represent ~96% of the total stablecoin market cap, which means stablecoins in the onchain economy have significantly increased TradFi risks throughout DeFi.

The integration of offchain assets throughout DeFi has been a net negative for the ecosystem. Centralized stablecoins are integrated virtually everywhere in DeFi. When we look at major DeFi platforms like Uniswap v3 on Ethereum and the Aave v3 markets, it's clear how deeply integrated centralized stablecoins are.

USDC and USDT account for 30.21% of all liquidity pairs in Uniswap v3’s Ethereum deployment, while USDC and USDT represent 23.97% of assets held in Aave v3 markets across networks. This isn’t a criticism of Uniswap or Aave, but rather a spotlight on how deeply interwoven our onchain markets are with offchain risks.

We need more decentralized onchain money to counter this trend.

How to Create Decentralized Onchain Money

We know users are looking to store value onchain, preserve their purchasing power, and dampen their exposure to volatility. To date, stablecoins have been the answer.

Unfortunately, existing stablecoin models are limited to being either capital-efficient yet centralized or decentralized but capital-inefficient. No decentralized model to date has been able to overtake their centralized counterparts. In addition to being predominantly centralized, stablecoins also have their buying power eroded by inflation, which varies depending on what asset a stablecoin is pegged to. In the last year, a new low volatility store of value–the flatcoin–has started to gain traction.

By design, flatcoins are censorship and inflation resistant because they are backed only by decentralized collateral. A flatcoin should have zero exposure to legacy offchain financial risks. Unlike a stablecoin, a flatcoin is a yield-bearing asset that natively preserves purchasing power and reduces external dependencies wherever possible.

At Flat Money, we believe that ETH is the best collateral for decentralized money. Pure ETH is also the most widely integrated collateral asset in DeFi. People are always looking for the best yield opportunities for their ETH. Past attempts at creating native onchain money haven’t been able to offer competitive yields on ETH once inflation and borrow rates are taken into account. This is especially true post merge.

With ETH liquid staking derivatives (LSDs), onchain money can have collateral backing that inherits the value of the Ethereum network as it scales, plays an important role in securing the network, and provides users with a base yield. A flatcoin backed by staked ETH can scale as the Ethereum network does while helping to promote the security of the network.

Others have pointed out that using LSDs to back stablecoins or flatcoins comes with added risk that could be avoided by having pure ETH as the collateral backing. That may be true, but an LSD backing is considerably less risky than saturating the onchain economy with a greater degree of centralized assets tied to TradFi.

To edge out existing onchain money backed by centralized assets, we need more decentralized money with LSD and pure ETH backing. We should be offering an actual alternative to TradFi, rather than a merely tokenized version of it onchain that allows centralized issuers to censor users at will and cause economic meltdowns when their offchain negligence impacts onchain markets.

This is why we believe in The ETH Standard.

The ETH Standard: Enabling a Better Form of Onchain Money

In the Ethereum ecosystem, there is no better asset to back onchain money than staked ETH itself. While pure ETH alone has not been sufficient to scale onchain money, staked ETH, or a mix of staked ETH and pure ETH, can scale with onchain money as long as certain conditions are met.

Onchain money with a fixed peg will also require either a centralized approach or a high degree of overcollateralization, which is a tradeoff many users are not willing to make. Instead, onchain money should have a floating peg or a design that allows for moderate fluctuations in value—albeit ones that are minor in comparison to the volatility of the underlying staked ETH or pure ETH.

This style of onchain money should have a more capital-efficient model or one that doesn’t require liquidations of the underlying collateral. Instead, the underlying staked ETH or ETH collateral can fluctuate in value while the fiat value of the onchain money grows over time. This allows for greater capital efficiency and a floating peg that allows a protocol to dampen the volatility of the underlying asset while providing the user with a relatively stable asset. If it follows the flatcoin design, the asset can be more than stable—it can grow in value over time.

With staked ETH as the backing asset, this form of onchain money is free from the risks present in TradFi and allows this model for onchain money to scale over time along with the Ethereum network while promoting the security of the network.

A flatcoin design can complement other decentralized onchain money models and reduce our dependence on centralized collateral onchain.

At the end of the day, people want to store value, minimize their exposure to volatile assets, preserve their purchasing power, and transact freely in onchain markets. The ETH Standard provides a way to build better forms of onchain money.

In our next post, we’ll discuss The Case for UNIT, Flat Money’s decentralized delta-neutral flatcoin backed by Rocket Pool ETH (rETH) that’s built on Base.